Các chỉ số quan trọng ở bảng cân đối

Quote from bsdinsight on 26 November 2023, 03:14Các chỉ số quan trọng của bảng cân đối mà bạn cần phải theo sát

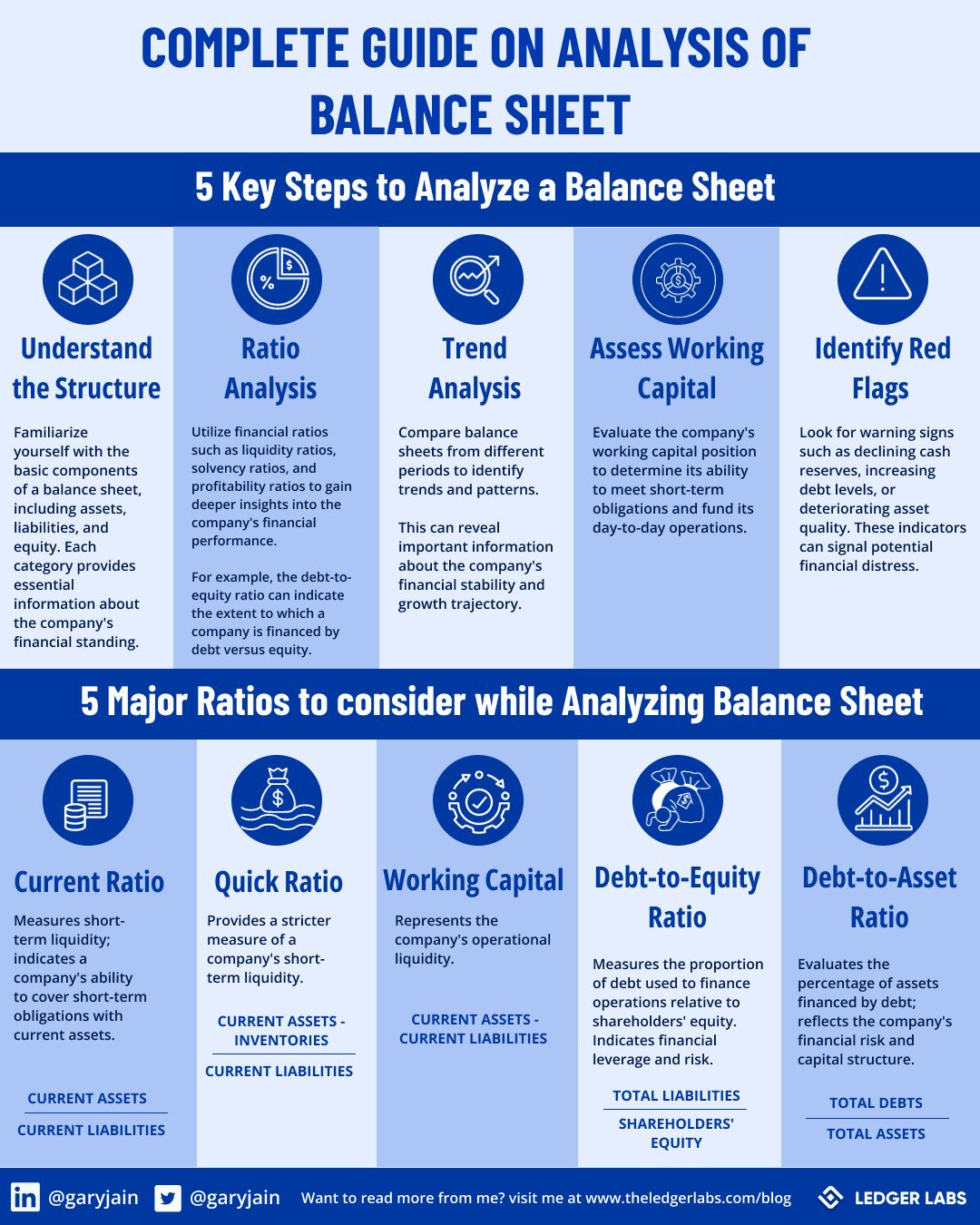

7/10 business owners are unable to interpret numbers on the balance sheet.

As a business owner,

It is necessary to know your company’s financial health for making informed decisions.

📍 Here’s Why Analyzing Balance Sheets Matters:

It provides a snapshot of your company’s financial position at a specific point in time.

It offers valuable insights into your company’s solvency, liquidity, and overall financial health.

📍 5 mistakes to avoid while analyzing the balance sheet:

1️⃣ Overlooking Comparative Analysis:

Compare current balances with prior periods to identify trends, anomalies, or sudden changes.

2️⃣ Ignoring Footnotes:

Always review accompanying footnotes for crucial information, like accounting policies or significant events affecting the financials.

3️⃣ Ignoring Contingent Liabilities:

Address potential liabilities, as they can impact future financial obligations and risk exposure.

4️⃣ Disregarding Non-Financial Factors:

Consider industry trends, economic conditions, and regulatory changes for a holistic analysis.

5️⃣ Failing to Assess Going Concern:

Evaluate if the company can sustain operations; look for signs of financial distress or viability concerns.

Các chỉ số quan trọng của bảng cân đối mà bạn cần phải theo sát

7/10 business owners are unable to interpret numbers on the balance sheet.

As a business owner,

It is necessary to know your company’s financial health for making informed decisions.

📍 Here’s Why Analyzing Balance Sheets Matters:

It provides a snapshot of your company’s financial position at a specific point in time.

It offers valuable insights into your company’s solvency, liquidity, and overall financial health.

📍 5 mistakes to avoid while analyzing the balance sheet:

1️⃣ Overlooking Comparative Analysis:

Compare current balances with prior periods to identify trends, anomalies, or sudden changes.

2️⃣ Ignoring Footnotes:

Always review accompanying footnotes for crucial information, like accounting policies or significant events affecting the financials.

3️⃣ Ignoring Contingent Liabilities:

Address potential liabilities, as they can impact future financial obligations and risk exposure.

4️⃣ Disregarding Non-Financial Factors:

Consider industry trends, economic conditions, and regulatory changes for a holistic analysis.

5️⃣ Failing to Assess Going Concern:

Evaluate if the company can sustain operations; look for signs of financial distress or viability concerns.