Chi phí vốn

Quote from bsdinsight on 20 November 2023, 10:47

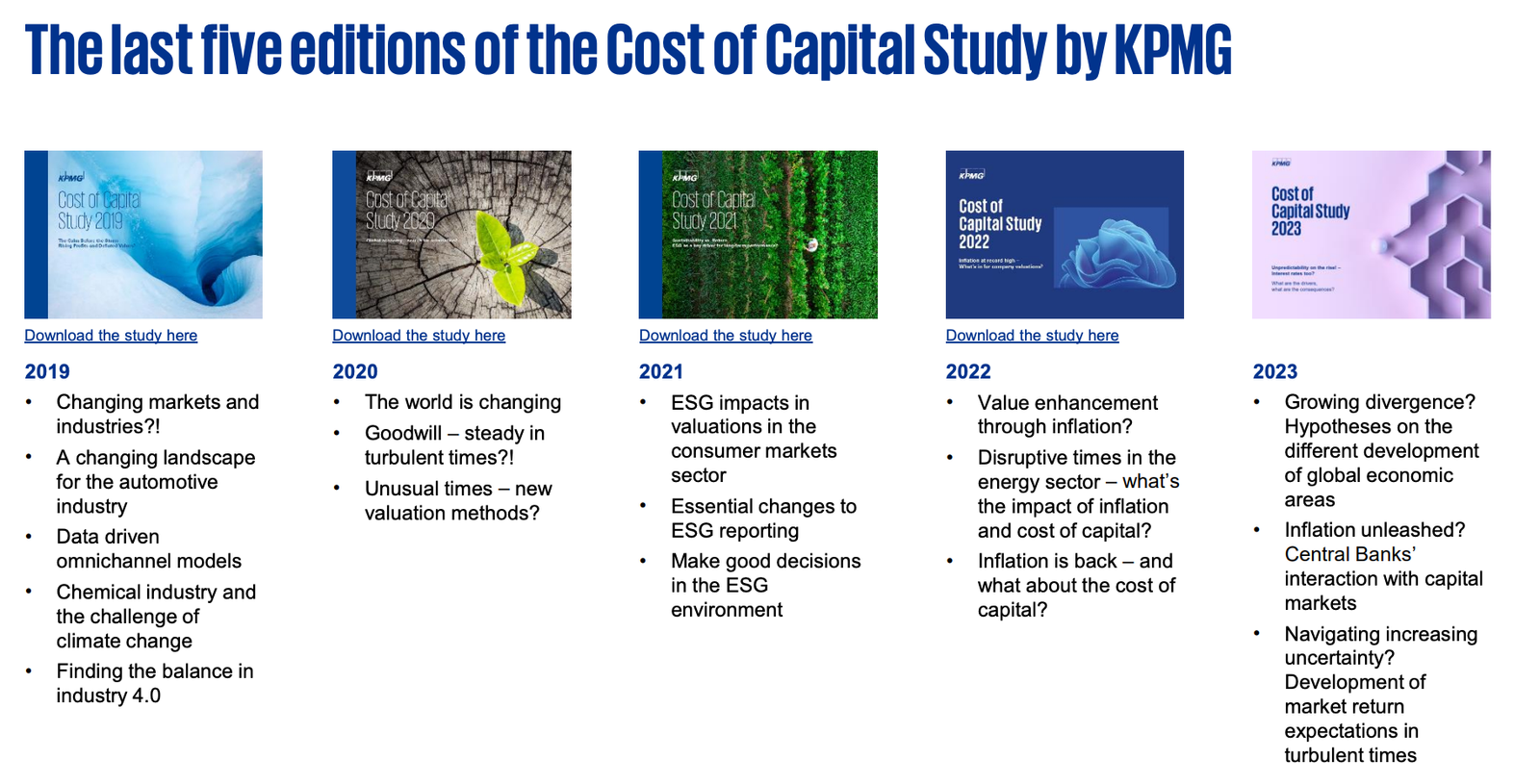

Một tài liệu của KPMG về xây dựng và quản lý chi phí vốn, tài liệu cực hay

Growth expectations

Growth expectations continue to be influenced by Russia’s war against Ukraine and rising interest and inflation rates. Although theanticipated sales growth has decreased slightly compared to the results of lastyear’s study, the forecasted EBIT growth has shown a significant increase.

WACC

Compared to the previous year, the average WACC across all industries increased significantly from 6.8 percent to 7.9 percent. Theincrease in WACC is in line with the development in the different sectors. The largest increase can be observed in the Real Estate sector, from 5.9 percent to 7.6 percent.

Market risk premium

The average market risk premium applied by participating companies declined from 7.2 percent in the previous year to 6.9 percent. Thedeclining trend is also observed in the cross-country comparison. In Germany, the market risk premium declined from 7.4 percent to 7.1 percent, in Austria from 7.5 percent to 7.2 percent and in Switzerland from 6.2 percent to 5.9 percent.

Cost of debt

Following a downward trend in recent years, the participating companies’ average cost of debt increased from 2.0 percent in the previous year to 3.8 percent during the survey period.

Triggering event

Compared to the previous year, there has been an increase in the percentage of participating companies that conducted an impairment test based on a triggering event, from 33 percent to 44 percent.

Planning uncertainty

To improve planning accuracy of future cash flows, it is important to consider relevant opportunities and risks. Compared to the previous year, participating companies placed greater emphasis on economic risks (macroeconomic) and risks from new technologies and digitisation (microeconomic).

Risk-free rate

During the survey period, the average risk-free rate increased by 1.6 percentage points to 1.9 percent. In Germany and Austria, the risk-free rate increased from 0.2 percent in 2021/2022 to 1.9 percent in 2022/2023. In Switzerland, the risk-free rate increased by 1.1 percentage points to 1.8 percent in 2022/2023.

Beta factors

The highest unlevered beta factors were again applied by the Technology sector, followed by the Automotive sector. The lowest unlevered beta factor continued to be applied by the participating companies in the Energy & Natural Resources sector.

Impairment test

The most recent period shows a slight increase in the number of companies recognising an impairment which could be attributable to the economic consequences of Russia’s war against Ukraine.

Sustainability

In recent years, ESG has become an increasingly important topic for companies. Even though the importance of ESG remains at a high level, it slightly declined compared to the previous year.

Tài liệu bao gồm

Introduction

Derivation of Cash Flows

Determination of the Cost of Capital Parameters

Impairment Test

Relevance of Value and Value Enhancement

Further Information

Xem và tải tài liệu tại đây

[dflip id="96178" ][/dflip]

Một tài liệu của KPMG về xây dựng và quản lý chi phí vốn, tài liệu cực hay

-

Growth expectations

Growth expectations continue to be influenced by Russia’s war against Ukraine and rising interest and inflation rates. Although theanticipated sales growth has decreased slightly compared to the results of lastyear’s study, the forecasted EBIT growth has shown a significant increase.

-

WACC

Compared to the previous year, the average WACC across all industries increased significantly from 6.8 percent to 7.9 percent. Theincrease in WACC is in line with the development in the different sectors. The largest increase can be observed in the Real Estate sector, from 5.9 percent to 7.6 percent.

-

Market risk premium

The average market risk premium applied by participating companies declined from 7.2 percent in the previous year to 6.9 percent. Thedeclining trend is also observed in the cross-country comparison. In Germany, the market risk premium declined from 7.4 percent to 7.1 percent, in Austria from 7.5 percent to 7.2 percent and in Switzerland from 6.2 percent to 5.9 percent.

-

Cost of debt

Following a downward trend in recent years, the participating companies’ average cost of debt increased from 2.0 percent in the previous year to 3.8 percent during the survey period.

-

Triggering event

Compared to the previous year, there has been an increase in the percentage of participating companies that conducted an impairment test based on a triggering event, from 33 percent to 44 percent.

-

Planning uncertainty

To improve planning accuracy of future cash flows, it is important to consider relevant opportunities and risks. Compared to the previous year, participating companies placed greater emphasis on economic risks (macroeconomic) and risks from new technologies and digitisation (microeconomic).

-

Risk-free rate

During the survey period, the average risk-free rate increased by 1.6 percentage points to 1.9 percent. In Germany and Austria, the risk-free rate increased from 0.2 percent in 2021/2022 to 1.9 percent in 2022/2023. In Switzerland, the risk-free rate increased by 1.1 percentage points to 1.8 percent in 2022/2023.

-

Beta factors

The highest unlevered beta factors were again applied by the Technology sector, followed by the Automotive sector. The lowest unlevered beta factor continued to be applied by the participating companies in the Energy & Natural Resources sector.

-

Impairment test

The most recent period shows a slight increase in the number of companies recognising an impairment which could be attributable to the economic consequences of Russia’s war against Ukraine.

-

Sustainability

In recent years, ESG has become an increasingly important topic for companies. Even though the importance of ESG remains at a high level, it slightly declined compared to the previous year.

Tài liệu bao gồm

-

Introduction

-

Derivation of Cash Flows

-

Determination of the Cost of Capital Parameters

-

Impairment Test

-

Relevance of Value and Value Enhancement

-

Further Information

Xem và tải tài liệu tại đây