Corporate Finance Modeling

Quote from bsdinsight on 20 November 2023, 15:23Chúng ta thử nhìn vào nội dung của 1 khoá hoc Corporate Finance Modeling để tìm hiểu xem các vấn đề liên quan tới Finance của doanh nghiệp

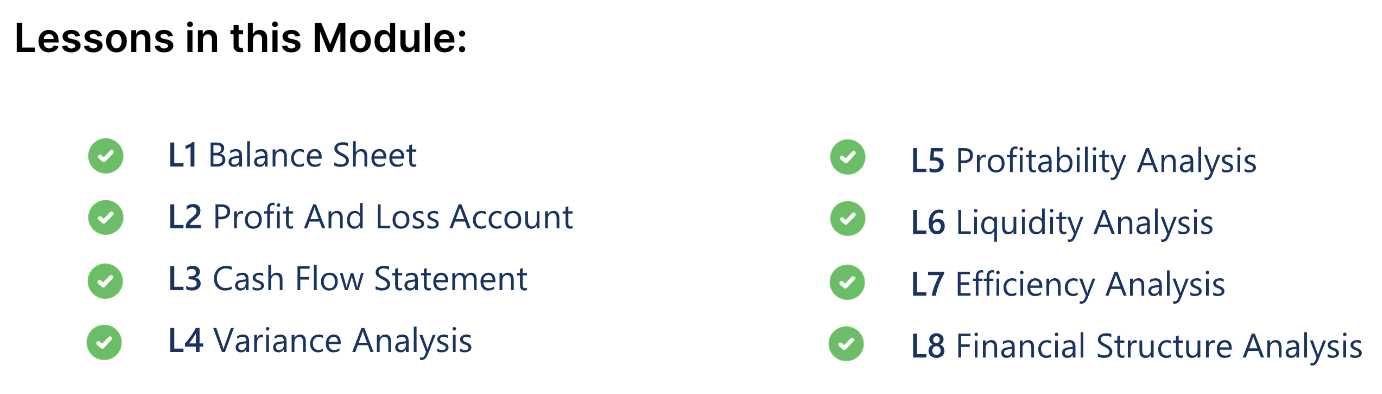

MODULE 1: Financial Statement Analysis

What will you Learn:

Build a functional and accurate financial statements.

Identify areas for KPIs improvement.

Understand and manage ratio numbers.

Perform different types of analysis like budget variance analysis, horizontal analysis, vertical analysis, breakeven point and more

What is included:

3 statements templates

Profitability, structure, efficiency and liquidity analysis model

Variance analysis model

Segmented P&L model, P&L models per industries

8 lessons and 30 pages of instructions in PDF manual

Chúng ta thử nhìn vào nội dung của 1 khoá hoc Corporate Finance Modeling để tìm hiểu xem các vấn đề liên quan tới Finance của doanh nghiệp

MODULE 1: Financial Statement Analysis

What will you Learn:

-

Build a functional and accurate financial statements.

-

Identify areas for KPIs improvement.

-

Understand and manage ratio numbers.

-

Perform different types of analysis like budget variance analysis, horizontal analysis, vertical analysis, breakeven point and more

What is included:

-

3 statements templates

-

Profitability, structure, efficiency and liquidity analysis model

-

Variance analysis model

-

Segmented P&L model, P&L models per industries

-

8 lessons and 30 pages of instructions in PDF manual

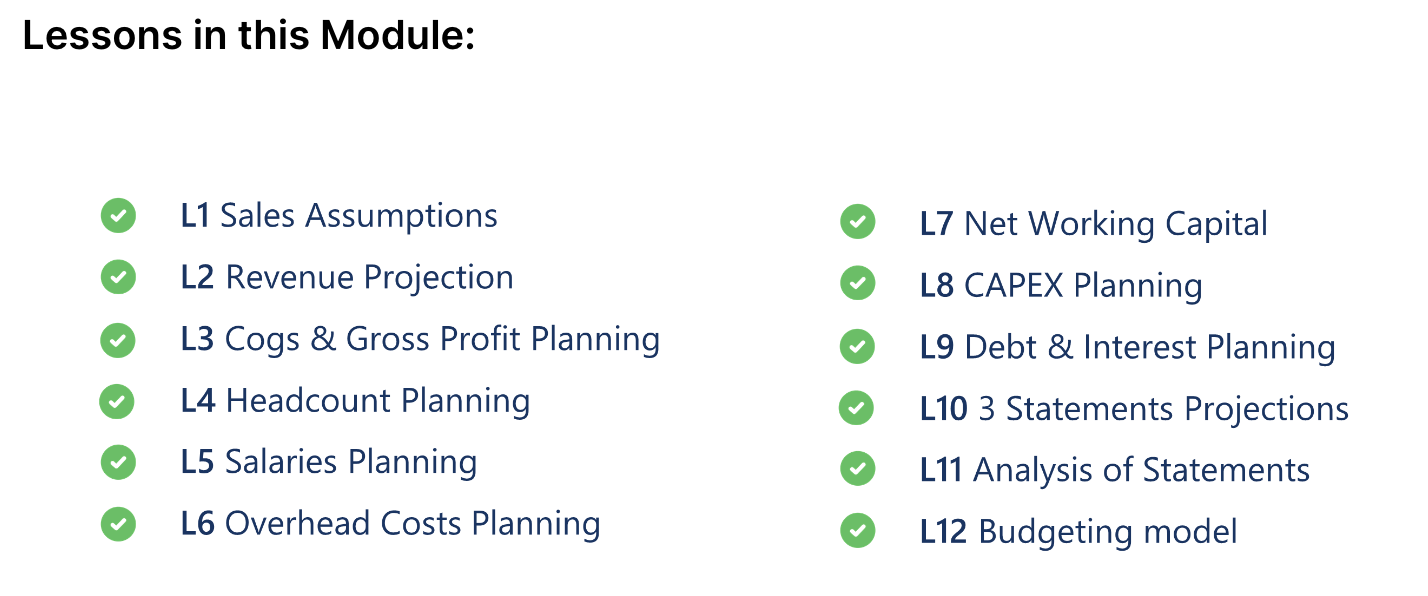

Quote from bsdinsight on 20 November 2023, 15:26MODULE 2: Financial Planning and Forecasting

What will you Learn:

Create a precise forecast and projection of financial statements.

Make informed decisions by providing a structured framework to project future outcomes

Preparation of company budget

What is Included:

Sales assumptions analytics.

Revenue & COGS and gross profit model.

Headcount, salaries model, and operating expenses model.

CAPEX, NWC and Debt planning models.

12 lessons and 55 pages of instructions in PDF manual.

MODULE 2: Financial Planning and Forecasting

What will you Learn:

-

Create a precise forecast and projection of financial statements.

-

Make informed decisions by providing a structured framework to project future outcomes

-

Preparation of company budget

What is Included:

-

Sales assumptions analytics.

-

Revenue & COGS and gross profit model.

-

Headcount, salaries model, and operating expenses model.

-

CAPEX, NWC and Debt planning models.

-

12 lessons and 55 pages of instructions in PDF manual.

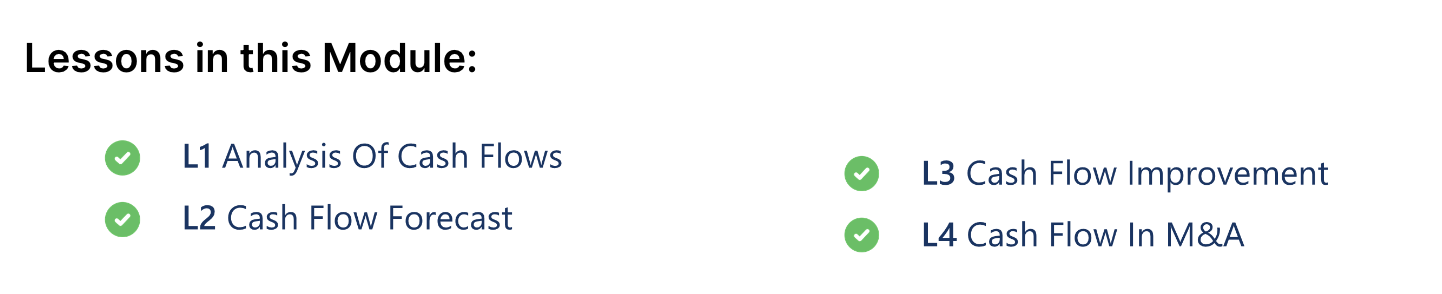

Quote from bsdinsight on 20 November 2023, 15:28MODULE 3: Cash Flow Management

What will you Learn:

Create more cash from business with advanced cash flow analysis and improvement techniques.

Increase liquidity and financial health with precise planning of weekly and monthly cash flow.

Successfully manage cash KPIs.

Use concept of cash in M&A transactions and valuations.

What is Included:

Monthly and annually cash flow planning model.

Weekly cash flow forecast model.

Proof of cash model.

4 lessons and 25 Pages of instructions in PDF manual

MODULE 3: Cash Flow Management

What will you Learn:

-

Create more cash from business with advanced cash flow analysis and improvement techniques.

-

Increase liquidity and financial health with precise planning of weekly and monthly cash flow.

-

Successfully manage cash KPIs.

-

Use concept of cash in M&A transactions and valuations.

What is Included:

-

Monthly and annually cash flow planning model.

-

Weekly cash flow forecast model.

-

Proof of cash model.

-

4 lessons and 25 Pages of instructions in PDF manual

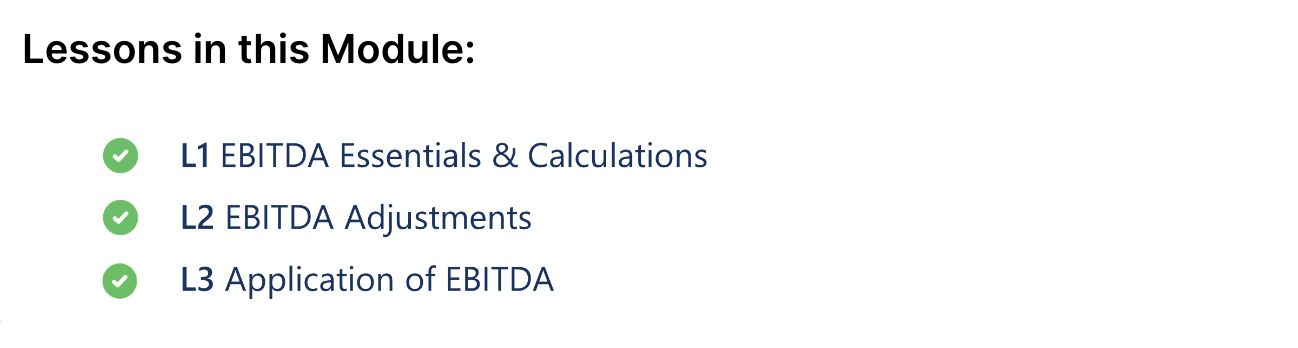

Quote from bsdinsight on 20 November 2023, 16:00MODULE 4: EBITDA

What will you Learn:

Understanding of EBITDA concept for different purposes.

Identification of EBITDA adjustments.

EBITDA adjustments on management vs diligence level.

What is Included:

Detailed model for identification 8 types of adjustments.

EBITDA Adjustments model.

3 lessons and 20 Pages of instructions in PDF manual.

MODULE 4: EBITDA

What will you Learn:

-

Understanding of EBITDA concept for different purposes.

-

Identification of EBITDA adjustments.

-

EBITDA adjustments on management vs diligence level.

What is Included:

-

Detailed model for identification 8 types of adjustments.

-

EBITDA Adjustments model.

-

3 lessons and 20 Pages of instructions in PDF manual.

Quote from bsdinsight on 20 November 2023, 16:02MODULE 5: BUSINESS VALUATIONS

What will you Learn:

Determining valuation of the any business, investment or projects.

Application of essential valuation methods.

Make precise discounting by understanding of cost of capital.

Identify comparable companies, transactions and multiples.

Understand and calculate key terms like WAAC, IRR, NPV, EVA, TV, EV and others.

What is Included:

Discounted cash flow model.

WACC model.

Comparable companies model.

Precedent transactions model.

Project evaluation model.

8 lessons and 45 pages of instructions in PDF manual.

MODULE 5: BUSINESS VALUATIONS

What will you Learn:

-

Determining valuation of the any business, investment or projects.

-

Application of essential valuation methods.

-

Make precise discounting by understanding of cost of capital.

-

Identify comparable companies, transactions and multiples.

-

Understand and calculate key terms like WAAC, IRR, NPV, EVA, TV, EV and others.

What is Included:

-

Discounted cash flow model.

-

WACC model.

-

Comparable companies model.

-

Precedent transactions model.

-

Project evaluation model.

-

8 lessons and 45 pages of instructions in PDF manual.

Quote from bsdinsight on 20 November 2023, 16:04BONUS

BONUS MODELS:

7 startup valuation models (simplified)

Startup finance model

Employee bonus scheme model

MRR & ARR forecast model

SaaS metrics model

Simplified 3 statements model

BONUS MATERIALS:

Finance abbreviations list

Annual financial statement closing checklist

Budgeting checklist

Cost budgeting handbook

Finance modeling handbook

Budgeting handbook

Corporate finance handbook

Valuation handbook

KPIs handbook

BONUS M&A:

Leveraged buyout model

Goodwill impairment excel model

Financial due diligence checklist

BONUS

BONUS MODELS:

-

7 startup valuation models (simplified)

-

Startup finance model

-

Employee bonus scheme model

-

MRR & ARR forecast model

-

SaaS metrics model

-

Simplified 3 statements model

BONUS MATERIALS:

-

Finance abbreviations list

-

Annual financial statement closing checklist

-

Budgeting checklist

-

Cost budgeting handbook

-

Finance modeling handbook

-

Budgeting handbook

-

Corporate finance handbook

-

Valuation handbook

-

KPIs handbook

BONUS M&A:

-

Leveraged buyout model

-

Goodwill impairment excel model

-

Financial due diligence checklist