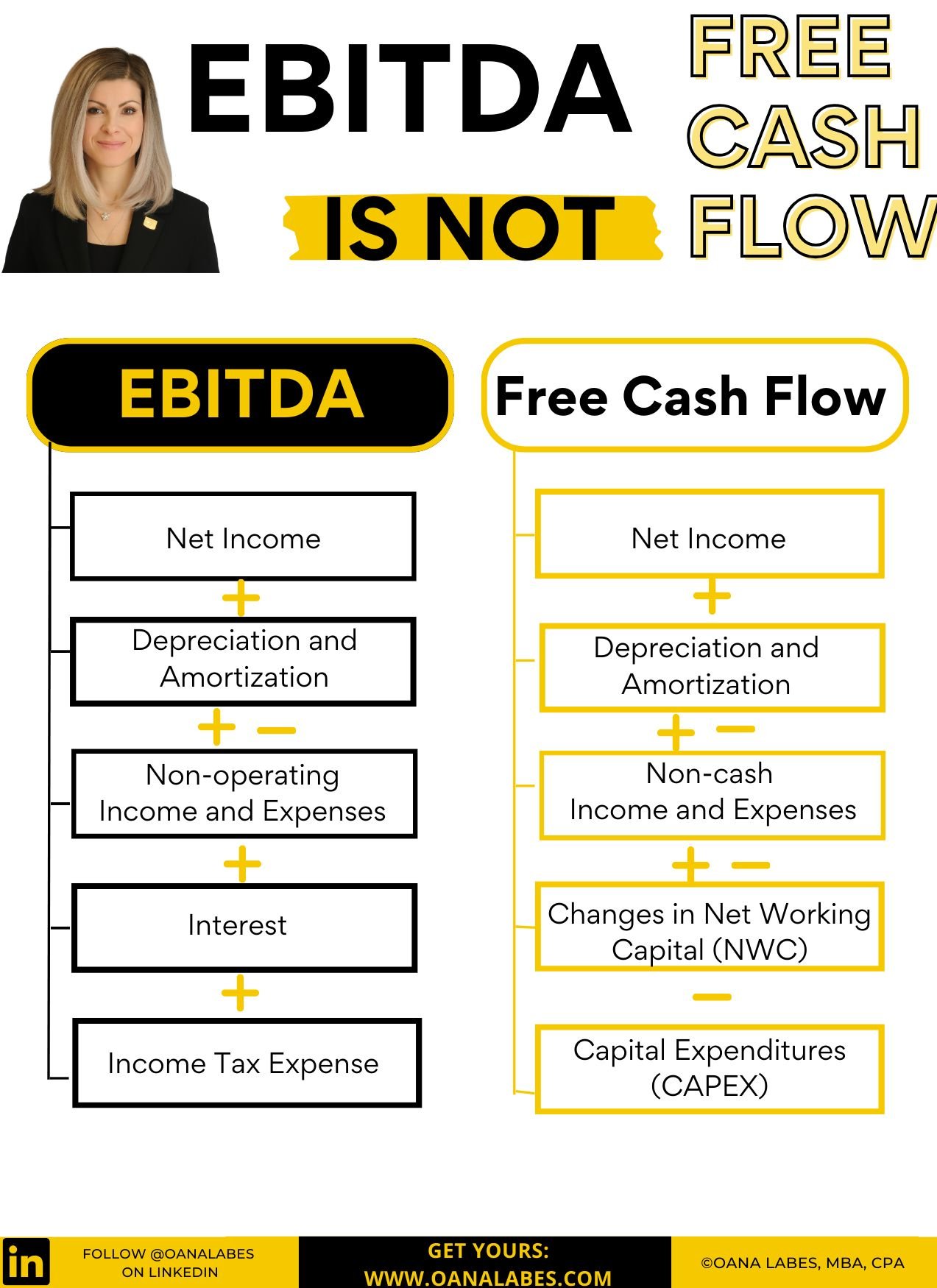

EBITDA có phải là Free Cash Flow không?

Quote from bsdinsight on 22 November 2023, 19:13

1️⃣ EBITDA is not a GAAP metric so everyone calculates it however they like.

Then they try to persuade you to buy into their formula.

2️⃣ EBITDA implies that all net income translates into cash the same way, ignoring non cash expenses and working capital changes.

3️⃣ EBITDA does not consider the amount of required reinvestment in fixed assets.

For capital intensive businesses, at a minimum these should cover minimum replacement CAPEX and roughly match non-cash depreciation expense.

4️⃣ EBITDA implies that the company will first use available cash flows to repay debt principal payment obligations.

In fact it could distribute it all to the shareholders before any debt payments are made.

5️⃣ EBITDA doesn’t say anything about the quality of earnings, which could be poor due to aggressive revenue and expense recognition policies.

🎯 If EBITDA is flawed and so far off cash flow, we need cash flow metric to replace it.

What about 𝗙𝗿𝗲𝗲 𝗖𝗮𝘀𝗵 𝗙𝗹𝗼𝘄 (𝗙𝗖𝗙)?

☑️ This is the cash remaining in the business after considering cash outflows that support its operations (OPEX + working capital) and maintain its fixed capital assets (CAPEX).

☑️ Free Cash Flow (FCF) Formula

= Operating Cash Flow +/- Changes in Fixed Assets☑️ Advantages of Free Cash Flow:

✅ Easy to calculate

✅ Available to both capital providers and borrowers

✅ Resolves some important EBITDA flaws and accounts for both CAPEX and cash consumed by sales growth or working capital efficiency losses☑️ Limitations of Free Cash Flow:

❌Assumes all CAPEX is a required investment, despite the fact most companies have an annual mix of replacement and growth CAPEX

❌Overstates CAPEX in the year of acquisition and understates it in subsequent years

❌There is no standardized calculation of Free Cash Flow so for external use it’s important to check with your banks or investors for their definitions

❌ Can be manipulated just like the other accounting metrics. A company that wants to increase free cash flow can simply under-invest in fixed assets.

1️⃣ EBITDA is not a GAAP metric so everyone calculates it however they like.

Then they try to persuade you to buy into their formula.

2️⃣ EBITDA implies that all net income translates into cash the same way, ignoring non cash expenses and working capital changes.

3️⃣ EBITDA does not consider the amount of required reinvestment in fixed assets.

For capital intensive businesses, at a minimum these should cover minimum replacement CAPEX and roughly match non-cash depreciation expense.

4️⃣ EBITDA implies that the company will first use available cash flows to repay debt principal payment obligations.

In fact it could distribute it all to the shareholders before any debt payments are made.

5️⃣ EBITDA doesn’t say anything about the quality of earnings, which could be poor due to aggressive revenue and expense recognition policies.

🎯 If EBITDA is flawed and so far off cash flow, we need cash flow metric to replace it.

What about 𝗙𝗿𝗲𝗲 𝗖𝗮𝘀𝗵 𝗙𝗹𝗼𝘄 (𝗙𝗖𝗙)?

☑️ This is the cash remaining in the business after considering cash outflows that support its operations (OPEX + working capital) and maintain its fixed capital assets (CAPEX).

☑️ Free Cash Flow (FCF) Formula

= Operating Cash Flow +/- Changes in Fixed Assets

☑️ Advantages of Free Cash Flow:

✅ Easy to calculate

✅ Available to both capital providers and borrowers

✅ Resolves some important EBITDA flaws and accounts for both CAPEX and cash consumed by sales growth or working capital efficiency losses

☑️ Limitations of Free Cash Flow:

❌Assumes all CAPEX is a required investment, despite the fact most companies have an annual mix of replacement and growth CAPEX

❌Overstates CAPEX in the year of acquisition and understates it in subsequent years

❌There is no standardized calculation of Free Cash Flow so for external use it’s important to check with your banks or investors for their definitions

❌ Can be manipulated just like the other accounting metrics. A company that wants to increase free cash flow can simply under-invest in fixed assets.