Forum breadcrumbs – You are here:ForumQuản trị doanh nghiệp: Quản trị doanh nghiệpEBITDA vs. Operating Cash Flow (O …

EBITDA vs. Operating Cash Flow (OCF)

bsdinsight@bsdinsight-com

837 Posts

#1 · 16 May 2025, 16:51

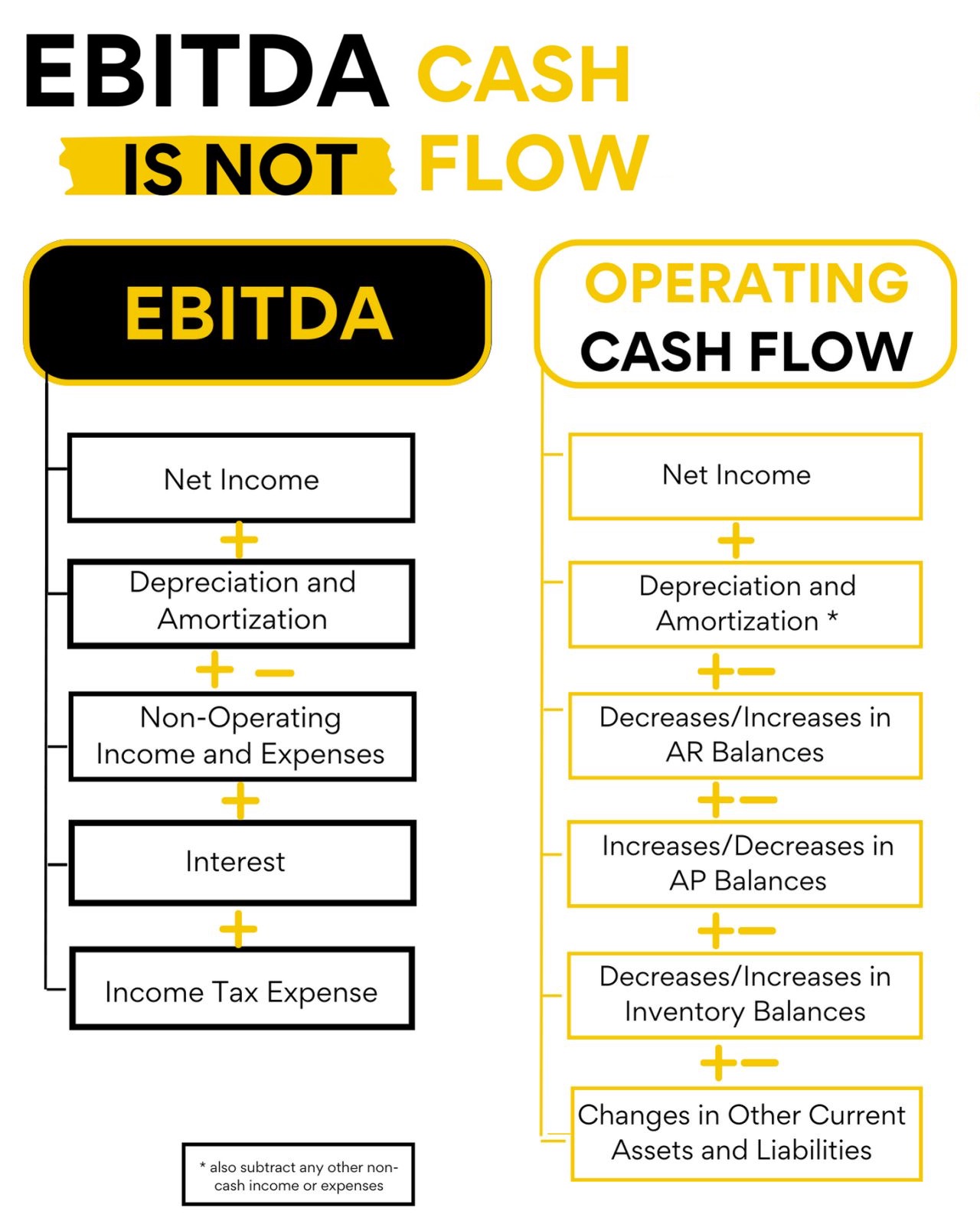

Quote from bsdinsight on 16 May 2025, 16:51The image and text both highlight the key differences between EBITDA and Operating Cash Flow (OCF), emphasizing why EBITDA is not a substitute for cash flow analysis. Here’s a concise breakdown of the main points:

EBITDA vs. Operating Cash Flow (OCF)

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- Calculated as: Net Income + Depreciation & Amortization + Non-Operating Income/Expenses + Interest + Income Tax Expense.

- Focuses on profitability, excluding non-cash expenses and certain financial costs.

- Ignores cash impacts like taxes paid, working capital changes, and capital expenditures (CapEx).

- Often adjusted for “one-time items,” which may obscure actual cash movement.

- Operating Cash Flow (OCF):

- Calculated as: Net Income + Depreciation & Amortization + Changes in Working Capital (e.g., AR, AP, Inventory) + Changes in Other Current Assets/Liabilities.

- Reflects actual cash generated from operations, capturing liquidity.

- Includes cash impacts of taxes, working capital changes (e.g., increases/decreases in AR, AP, Inventory), and other cash costs like severance or stock-based compensation.

Key Differences Highlighted

- Taxes: EBITDA excludes taxes, while OCF accounts for taxes paid, showing the real cash impact.

- Working Capital: OCF reflects changes in Accounts Receivable (AR), Accounts Payable (AP), and Inventory, which affect cash but are ignored by EBITDA.

- Cash Costs: Items like provisions, stock-based compensation, severance, and reorganization costs impact cash and are included in OCF, but often adjusted out of EBITDA.

- Non-Operating Items: EBITDA excludes grant income or extraordinary inflows, while OCF includes them as cash inflows.

- Capital Expenditures (CapEx): EBITDA doesn’t account for CapEx, but OCF (and Free Cash Flow) does, making it more reliable for assessing cash needs.

- Adjustments: EBITDA often adjusts for “one-time items,” while OCF reflects actual cash movement, regardless of labels.

Why It Matters

- EBITDA is useful for comparing profitability across companies but doesn’t show cash availability.

- OCF provides a clearer picture of liquidity, crucial for operational and strategic decisions.

- For critical decisions (e.g., deals, financing), focus on Discounted Cash Flow (DCF), Quality of Earnings (QoE), and working capital dynamics, as “cash is king.”

The image and text both highlight the key differences between EBITDA and Operating Cash Flow (OCF), emphasizing why EBITDA is not a substitute for cash flow analysis. Here’s a concise breakdown of the main points:

EBITDA vs. Operating Cash Flow (OCF)

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- Calculated as: Net Income + Depreciation & Amortization + Non-Operating Income/Expenses + Interest + Income Tax Expense.

- Focuses on profitability, excluding non-cash expenses and certain financial costs.

- Ignores cash impacts like taxes paid, working capital changes, and capital expenditures (CapEx).

- Often adjusted for “one-time items,” which may obscure actual cash movement.

- Operating Cash Flow (OCF):

- Calculated as: Net Income + Depreciation & Amortization + Changes in Working Capital (e.g., AR, AP, Inventory) + Changes in Other Current Assets/Liabilities.

- Reflects actual cash generated from operations, capturing liquidity.

- Includes cash impacts of taxes, working capital changes (e.g., increases/decreases in AR, AP, Inventory), and other cash costs like severance or stock-based compensation.

Key Differences Highlighted

- Taxes: EBITDA excludes taxes, while OCF accounts for taxes paid, showing the real cash impact.

- Working Capital: OCF reflects changes in Accounts Receivable (AR), Accounts Payable (AP), and Inventory, which affect cash but are ignored by EBITDA.

- Cash Costs: Items like provisions, stock-based compensation, severance, and reorganization costs impact cash and are included in OCF, but often adjusted out of EBITDA.

- Non-Operating Items: EBITDA excludes grant income or extraordinary inflows, while OCF includes them as cash inflows.

- Capital Expenditures (CapEx): EBITDA doesn’t account for CapEx, but OCF (and Free Cash Flow) does, making it more reliable for assessing cash needs.

- Adjustments: EBITDA often adjusts for “one-time items,” while OCF reflects actual cash movement, regardless of labels.

Why It Matters

- EBITDA is useful for comparing profitability across companies but doesn’t show cash availability.

- OCF provides a clearer picture of liquidity, crucial for operational and strategic decisions.

- For critical decisions (e.g., deals, financing), focus on Discounted Cash Flow (DCF), Quality of Earnings (QoE), and working capital dynamics, as “cash is king.”

Click for thumbs down.0Click for thumbs up.0