How to analyze companies

Quote from bsdinsight on 12 April 2025, 10:46How to analyze companies

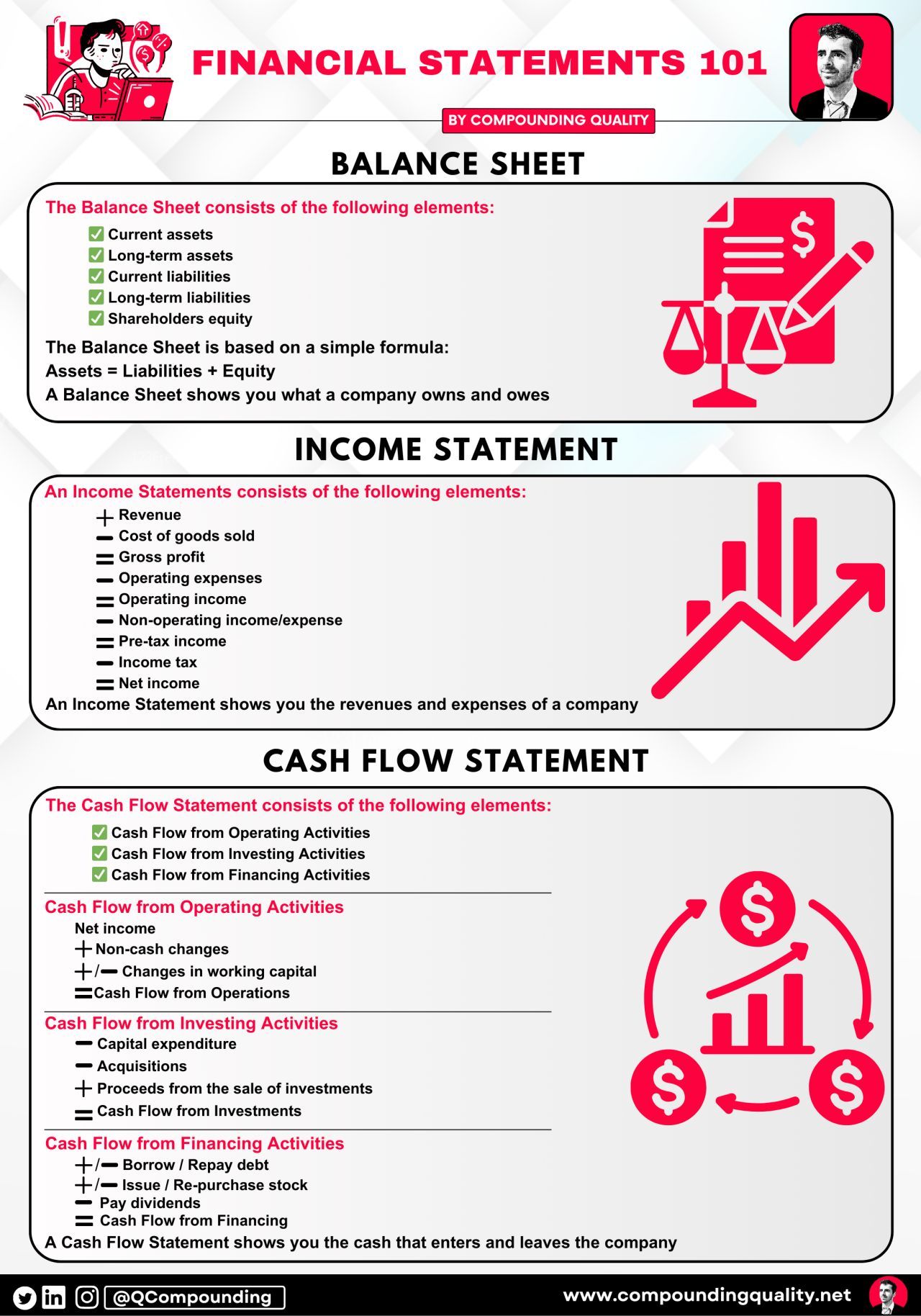

A huge part of that, is analyzing the 3 financial statements.

Here’s how to analyze and interpret the…

– Balance Sheet

– Income Statement

– Cash Flow StatementBalance Sheet:

The balance sheet consists of the following elements:

– Current assets

– Long-term assets

– Current liabilities

– Long-term liabilities

– Shareholders equityThe balance sheet is based on a simple formula:

Assets = Liabilities + Equities

A balance sheet shows you what a company owns and owes.

Income Statement:

An Income Statement shows you the revenues and expenses of a company.

It consists of the following elements:

Revenue

– COGS

= Gross Profit

– Operating Expenses

= Operating Income

– Non-Operating Income / Expenses

= Pre-Tax Income

– Income Tax

= Net IncomeCash Flow Statement:

A Cash Flow Statements shows you the cash that enters and leaves a company.

The Cash Flow Statements consists of 3 elements:

– Cash Flow from Operating Activities

– Cash Flow from Investing Activities

– Cash Flow from Financing ActivitiesCash Flow from Operating Activities:

Net Income

+ Non-Cash Changes

+/- Changes in Working Capital

= Cash Flow from Operating ActivitiesCash Flow from Investing Activities:

– Capital Expenditures

– Acquisitions

+ Proceeds from the Sale of Investments

= Cash Flow from Investing ActivitiesCash Flow from Financing Activities:

+/- Borrowing/Repaying Debt

+/- Issuing/Repurchasing Stocks

– Dividends Paid

= Cash Flow from Financing Activities

How to analyze companies

A huge part of that, is analyzing the 3 financial statements.

Here’s how to analyze and interpret the…

– Balance Sheet

– Income Statement

– Cash Flow Statement

Balance Sheet:

The balance sheet consists of the following elements:

– Current assets

– Long-term assets

– Current liabilities

– Long-term liabilities

– Shareholders equity

The balance sheet is based on a simple formula:

Assets = Liabilities + Equities

A balance sheet shows you what a company owns and owes.

Income Statement:

An Income Statement shows you the revenues and expenses of a company.

It consists of the following elements:

Revenue

– COGS

= Gross Profit

– Operating Expenses

= Operating Income

– Non-Operating Income / Expenses

= Pre-Tax Income

– Income Tax

= Net Income

Cash Flow Statement:

A Cash Flow Statements shows you the cash that enters and leaves a company.

The Cash Flow Statements consists of 3 elements:

– Cash Flow from Operating Activities

– Cash Flow from Investing Activities

– Cash Flow from Financing Activities

Cash Flow from Operating Activities:

Net Income

+ Non-Cash Changes

+/- Changes in Working Capital

= Cash Flow from Operating Activities

Cash Flow from Investing Activities:

– Capital Expenditures

– Acquisitions

+ Proceeds from the Sale of Investments

= Cash Flow from Investing Activities

Cash Flow from Financing Activities:

+/- Borrowing/Repaying Debt

+/- Issuing/Repurchasing Stocks

– Dividends Paid

= Cash Flow from Financing Activities