8 thể hiện của vị CFO

Quote from bsdinsight on 26 November 2023, 03:34The days when the CFO was only responsible for balancing the books and crunching the numbers are long gone.

Instead, today’s business environment is fast-paced, and dynamic, and relies on people who thrive on constant change.

Does that sound like the traditional perception of a chief financial officer?

As business partners, we come across many different kinds of CFO, each possessing a range of diverse and important skills.

And, as the CFO role continues to be the fastest evolving C-suite role, it’s important to recognize the distinct types of CFOs that exist in companies today.

Each brings their own unique strengths and talents to the conference table, so let’s find out what they are:

A dynamic and multifaceted role means wearing multiple hats

Each CFO we’ve worked with exhibits a preference for between one and four of the below types. How many do you recognize in yourself? How about amongst your colleagues?

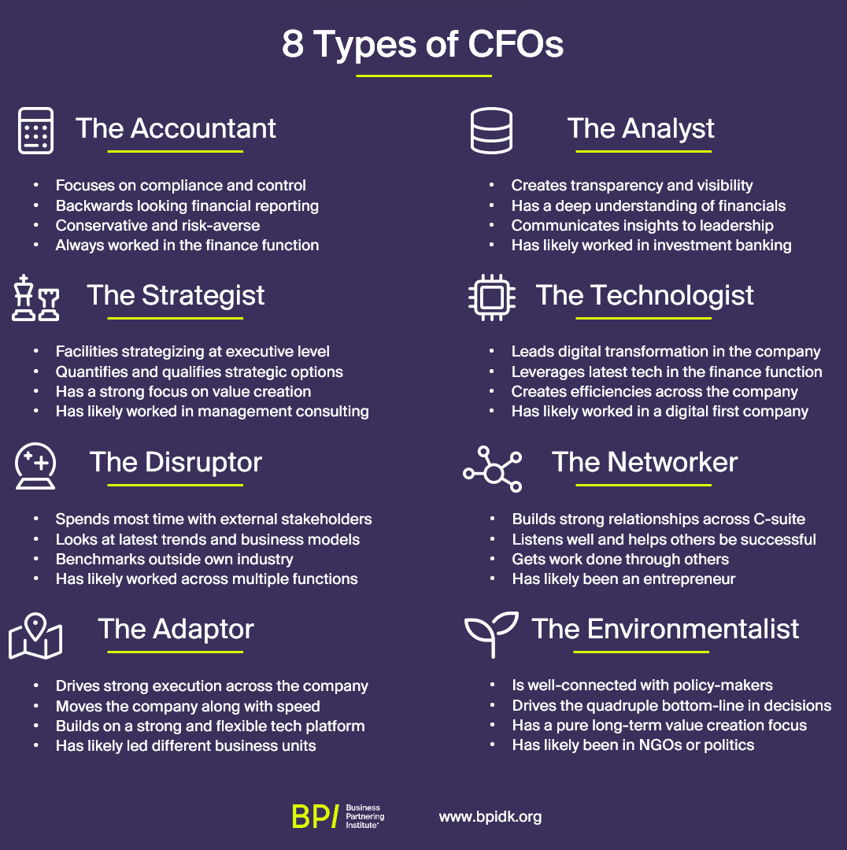

The accountant

A master-of-numbers. Focuses on clarity, compliance, and control. Think of the preferences of the accountants you know. They might be more calculating and less risk-taking.

They trust the system of accounts and are very good at financial reporting. This CFO-type is highly experienced in the finance function.

The analyst

A data visualizer, highly skilled in creating transparency and visibility. In-built understanding of financials and demonstrates this skill by providing leadership with deep analysis.

Skilled communicators are able to make even complex financial insights easily understood. May have a background in investment banking.

The strategist

A strategy facilitator at the executive level. Impressively adept at assessing strategic options by quantifying and qualifying them.

Decision-making strongly focuses on value creation. Likely spent time in management consulting.

The technologist

A digital transformer. Leveraging the latest technology in the finance function but creating efficiencies across the entire organization.

Likely worked in a digital-first company and so possess a deep knowledge of the impact technology transformations can have on a business.

The disruptor

A trendsetter. Always on top of the latest trends and business models. Might spend a lot of time with external stakeholders and be skilled at benchmarking against diverse outside industries.

Likely worked across multiple functions and sectors and owns a creative approach to solving problems.

The networker

A C-suite relationship-builder. Someone who listens skillfully and uses what they hear to help others achieve success. Well-practiced puppeteers and master delegators who are able to get their work done via their teams.

May have entertained the idea of being an entrepreneur in their past career.

The adaptor

An execution-driver. Clear processes and systems allow efficient and effective execution. Prioritizes tasks and initiatives that have the greatest impact which moves the company forward at speed while simultaneously building a strong yet flexible tech platform.

Likely to have been a leader in different business units in the company.

The environmentalist

A well-connected policy guru. Focuses on the quadruple bottom line in decision-making: social, environmental, and profitable. Committed to creating long-term value and contributing positively to their community.

Deep understanding of the importance of sustainability in business. Likely worked at an NGO or in government.

The days when the CFO was only responsible for balancing the books and crunching the numbers are long gone.

Instead, today’s business environment is fast-paced, and dynamic, and relies on people who thrive on constant change.

Does that sound like the traditional perception of a chief financial officer?

As business partners, we come across many different kinds of CFO, each possessing a range of diverse and important skills.

And, as the CFO role continues to be the fastest evolving C-suite role, it’s important to recognize the distinct types of CFOs that exist in companies today.

Each brings their own unique strengths and talents to the conference table, so let’s find out what they are:

A dynamic and multifaceted role means wearing multiple hats

Each CFO we’ve worked with exhibits a preference for between one and four of the below types. How many do you recognize in yourself? How about amongst your colleagues?

The accountant

A master-of-numbers. Focuses on clarity, compliance, and control. Think of the preferences of the accountants you know. They might be more calculating and less risk-taking.

They trust the system of accounts and are very good at financial reporting. This CFO-type is highly experienced in the finance function.

The analyst

A data visualizer, highly skilled in creating transparency and visibility. In-built understanding of financials and demonstrates this skill by providing leadership with deep analysis.

Skilled communicators are able to make even complex financial insights easily understood. May have a background in investment banking.

The strategist

A strategy facilitator at the executive level. Impressively adept at assessing strategic options by quantifying and qualifying them.

Decision-making strongly focuses on value creation. Likely spent time in management consulting.

The technologist

A digital transformer. Leveraging the latest technology in the finance function but creating efficiencies across the entire organization.

Likely worked in a digital-first company and so possess a deep knowledge of the impact technology transformations can have on a business.

The disruptor

A trendsetter. Always on top of the latest trends and business models. Might spend a lot of time with external stakeholders and be skilled at benchmarking against diverse outside industries.

Likely worked across multiple functions and sectors and owns a creative approach to solving problems.

The networker

A C-suite relationship-builder. Someone who listens skillfully and uses what they hear to help others achieve success. Well-practiced puppeteers and master delegators who are able to get their work done via their teams.

May have entertained the idea of being an entrepreneur in their past career.

The adaptor

An execution-driver. Clear processes and systems allow efficient and effective execution. Prioritizes tasks and initiatives that have the greatest impact which moves the company forward at speed while simultaneously building a strong yet flexible tech platform.

Likely to have been a leader in different business units in the company.

The environmentalist

A well-connected policy guru. Focuses on the quadruple bottom line in decision-making: social, environmental, and profitable. Committed to creating long-term value and contributing positively to their community.

Deep understanding of the importance of sustainability in business. Likely worked at an NGO or in government.

Quote from bsdinsight on 26 November 2023, 03:37What it takes to be a successful CFO today

No role is evolving faster than that of the CFO. As leaders, CFOs need to wear multiple hats to succeed in the job today.

Most of the successful CFOs we work with are a mix of inspirational people leaders, digital leaders, and long-term value leaders able to adapt to the changing needs of their company.

These kinds of CFOs are change agents who can drive talent and culture, accelerate digitization, and create long-term value for multiple stakeholders.

A trend we’re seeing is that, because the demands on the CFO are changing so fast, people who aren’t able to adapt, often end up leaving. In fact, we’re noticing that the length of the current CFO tenure is decreasing in general compared to other CXO roles.

That’s why at BPI we recognize that there is no “one size fits all” CFO nor would we wish there to be.

Variety and diversity are keys to organizational success at all levels.

We believe CFOs are capable of being inspirational people leaders, working seamlessly across the organization, and driving the talent and culture agenda in Finance by being motivational change agents.

CFOs should also be important digital leaders, driving bold, and innovative strategies to accelerate the digitization of Finance.

We also think CFOs can be long-term value leaders by leading changes in how we measure and communicate corporate value, moving away from short-term reporting towards long-term value thinking.

No one CFO fits neatly into any one “type” but should be able to flex between different behaviors, according to the specific needs of the company at different times.

What do you think about the examples above, do these types make sense for how you see the CFO role today? And, are there any you’d add or take away? Let us know in the comments below.

What it takes to be a successful CFO today

No role is evolving faster than that of the CFO. As leaders, CFOs need to wear multiple hats to succeed in the job today.

Most of the successful CFOs we work with are a mix of inspirational people leaders, digital leaders, and long-term value leaders able to adapt to the changing needs of their company.

These kinds of CFOs are change agents who can drive talent and culture, accelerate digitization, and create long-term value for multiple stakeholders.

A trend we’re seeing is that, because the demands on the CFO are changing so fast, people who aren’t able to adapt, often end up leaving. In fact, we’re noticing that the length of the current CFO tenure is decreasing in general compared to other CXO roles.

That’s why at BPI we recognize that there is no “one size fits all” CFO nor would we wish there to be.

Variety and diversity are keys to organizational success at all levels.

We believe CFOs are capable of being inspirational people leaders, working seamlessly across the organization, and driving the talent and culture agenda in Finance by being motivational change agents.

CFOs should also be important digital leaders, driving bold, and innovative strategies to accelerate the digitization of Finance.

We also think CFOs can be long-term value leaders by leading changes in how we measure and communicate corporate value, moving away from short-term reporting towards long-term value thinking.

No one CFO fits neatly into any one “type” but should be able to flex between different behaviors, according to the specific needs of the company at different times.

What do you think about the examples above, do these types make sense for how you see the CFO role today? And, are there any you’d add or take away? Let us know in the comments below.