How to analyze a Cash Flow Statement

Quote from bsdinsight on 15 April 2025, 23:56🔍 How to analyze a Cash Flow Statement

Earnings are an opinion, cash flow is a fact.

That’s why a Cash Flow Statements is one of the most important parts of a 10-K.

1️⃣ What is a Cash Flow statement?

A cash flow statement shows you how much cash goes in and out a company over a certain period.

The purpose of this statement is to track how much cash is moving through a business.

You want to invest in companies that generate cash and manage their cash position very well.

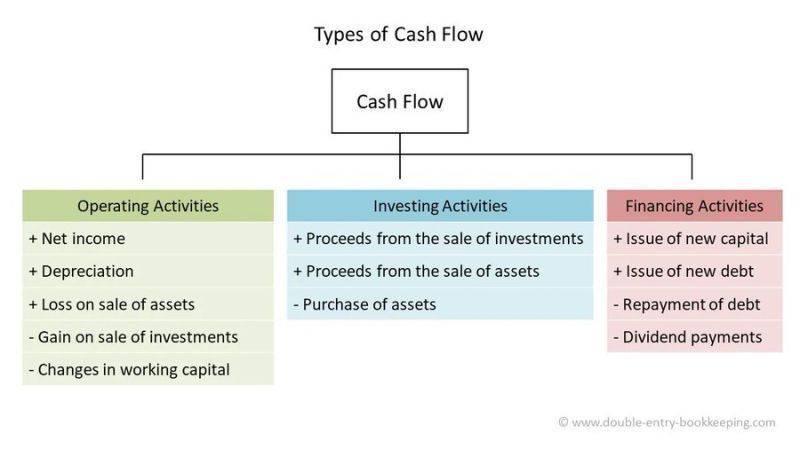

Every cash flow statement consists of 3 parts:

– Cash Flow from Operating Activities

– Cash Flow from Investing Activities

– Cash Flow from Financing Activities2️⃣ Cash Flow from Operating Activities

This section shows all cash the company generated from its normal business activities.

In other words: it shows you all the cash a company earned from selling its normal products and/or services.

When a beer company generates $2 per beer in operating cash flow and sold 2 million beers in a certain year, its cash flow from operating activities would be equal to $4 million.

The cash flow from operating activities is comparable to net income, but it filters out a few income and expense posts that didn’t cause actual cash to enter or exit the company.

You can calculate the cash flow from operating activities as follows:

Cash Flow from operating activities = net income + non-cash charges +/- changes in working capital

3️⃣ Cash Flow from Investing Activities

The Cash Flow from Investing Activities gives you an overview about the company’s investment related income and expenditures.

The Cash Flow from Investing Activities consists of 3 major parts:

– Capital expenditures (CAPEX)

– Mergers & Acquisitions

– Marketable securitiesYou can calculate the cash flow from investing activities as follows:

Cash flow from investing activities = Sale of marketable securities + divestments – CAPEX – Mergers & Acquisitions – purchase of marketable securities

5️⃣ Cash Flow from Financing Activities

Last but not least, the Cash Flow from Financing Activities measures the cash movements between a company and its owners (shareholders) and its debtors (bondholders).

This section gives you an insight about how the company is financing its business activities.

The Cash Flow from Financing Activities consists of 3 major parts:

You can calculate the cash flow from financing activities as follows:

Cash Flow from financing activities = Debt issuance + issuance of new stocks – dividends – debt repayments – share buybacks

6️⃣Changes in cash balance

Finally, you can calculate the total changes in the cash balance:

Cash at the end of the year = Cash at the beginning of the year + CF from operating activities + CF from investing activities + CF from financing activities

🔍 How to analyze a Cash Flow Statement

Earnings are an opinion, cash flow is a fact.

That’s why a Cash Flow Statements is one of the most important parts of a 10-K.

1️⃣ What is a Cash Flow statement?

A cash flow statement shows you how much cash goes in and out a company over a certain period.

The purpose of this statement is to track how much cash is moving through a business.

You want to invest in companies that generate cash and manage their cash position very well.

Every cash flow statement consists of 3 parts:

– Cash Flow from Operating Activities

– Cash Flow from Investing Activities

– Cash Flow from Financing Activities

2️⃣ Cash Flow from Operating Activities

This section shows all cash the company generated from its normal business activities.

In other words: it shows you all the cash a company earned from selling its normal products and/or services.

When a beer company generates $2 per beer in operating cash flow and sold 2 million beers in a certain year, its cash flow from operating activities would be equal to $4 million.

The cash flow from operating activities is comparable to net income, but it filters out a few income and expense posts that didn’t cause actual cash to enter or exit the company.

You can calculate the cash flow from operating activities as follows:

Cash Flow from operating activities = net income + non-cash charges +/- changes in working capital

3️⃣ Cash Flow from Investing Activities

The Cash Flow from Investing Activities gives you an overview about the company’s investment related income and expenditures.

The Cash Flow from Investing Activities consists of 3 major parts:

– Capital expenditures (CAPEX)

– Mergers & Acquisitions

– Marketable securities

You can calculate the cash flow from investing activities as follows:

Cash flow from investing activities = Sale of marketable securities + divestments – CAPEX – Mergers & Acquisitions – purchase of marketable securities

5️⃣ Cash Flow from Financing Activities

Last but not least, the Cash Flow from Financing Activities measures the cash movements between a company and its owners (shareholders) and its debtors (bondholders).

This section gives you an insight about how the company is financing its business activities.

The Cash Flow from Financing Activities consists of 3 major parts:

You can calculate the cash flow from financing activities as follows:

Cash Flow from financing activities = Debt issuance + issuance of new stocks – dividends – debt repayments – share buybacks

6️⃣Changes in cash balance

Finally, you can calculate the total changes in the cash balance:

Cash at the end of the year = Cash at the beginning of the year + CF from operating activities + CF from investing activities + CF from financing activities