Below is an introduction and detailed explanation of the components in the provided Retail Banking Business Architecture diagram. The explanation is structured to cover the main sections and their respective components, ensuring clarity and comprehensiveness.

Introduction to Retail Banking Business Architecture

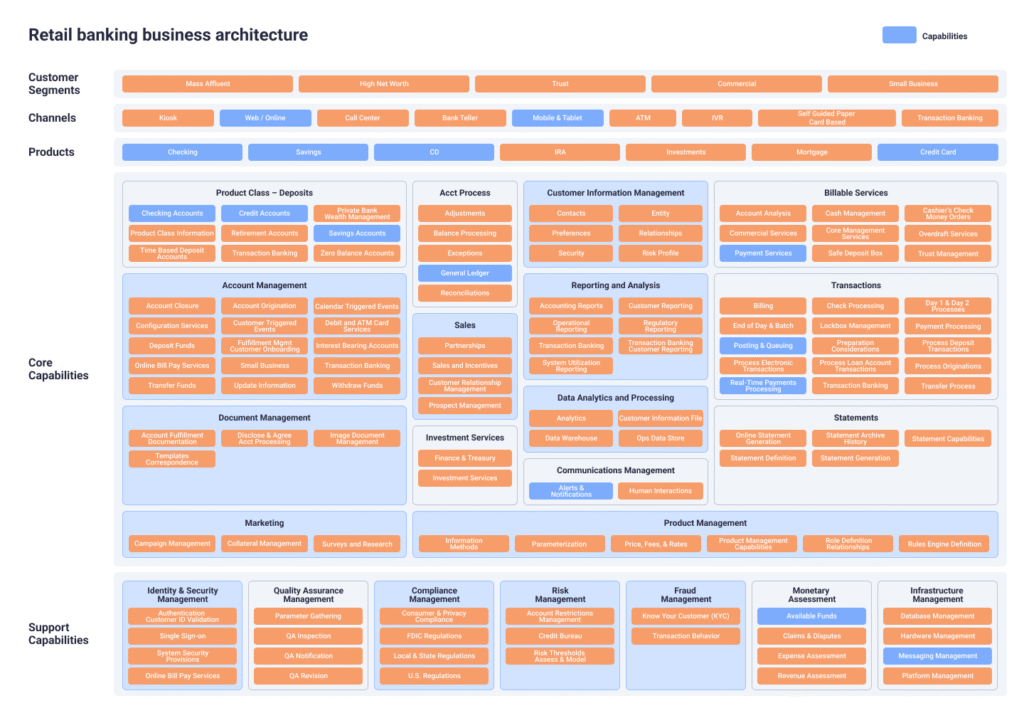

The Retail Banking Business Architecture diagram provides a comprehensive framework that outlines the key components required to operate a retail banking institution effectively. It organizes the bank’s operations into logical categories, including customer segments, channels, products, core capabilities, and support capabilities. This architecture serves as a blueprint for understanding how various functions, processes, and services interact to deliver value to customers while ensuring operational efficiency, compliance, and strategic alignment. By breaking down the complex operations of a retail bank into manageable components, this design facilitates better planning, integration, and optimization of banking services.

The diagram is divided into several key sections: Customer Segments, Channels, Products, Core Capabilities, and Support Capabilities. Each section contains specific components that represent the building blocks of retail banking operations. Below, we explore these sections and their components in detail.

Explanation of Components

1. Customer Segments

This section identifies the different types of customers a retail bank serves. Each segment has unique needs and preferences, which influence the design of products, channels, and services.

- Mass Affluent: Customers with moderate to high income who seek personalized banking services, such as investment options and premium accounts.

- High Net Worth: Wealthy individuals requiring sophisticated financial products like private banking, wealth management, and trust services.

- Trust: Customers or entities managing trust accounts, often requiring fiduciary services and estate planning.

- Commercial: Businesses of varying sizes that need banking services like loans, merchant services, and cash management.

- Small Business: Smaller enterprises requiring tailored financial solutions, such as business checking accounts and lines of credit.

2. Channels

Channels represent the various ways customers interact with the bank. These touchpoints are critical for delivering services and ensuring accessibility.

- Kiosk: Self-service terminals for quick transactions like deposits or withdrawals.

- Web/Online: Online banking platforms for account management, bill payments, and transfers.

- Call Center: Phone-based customer support for inquiries, complaints, and transactions.

- Bank Teller: In-person services at bank branches for complex transactions and consultations.

- Mobile & Tablet: Mobile apps for banking on-the-go, including account monitoring and payments.

- ATM: Automated teller machines for cash withdrawals, deposits, and balance inquiries.

- IVR (Interactive Voice Response): Automated phone systems for basic inquiries and transactions.

- Self-Guided Paper Card: Physical forms or cards for specific transactions, often used in legacy systems.

- Transaction Banking: Specialized services for high-volume or complex transactions, often for commercial clients.

3. Products

This section lists the core financial products offered to customers, addressing their saving, borrowing, and investment needs.

- Checking: Accounts for daily transactions, such as bill payments and purchases.

- Savings: Accounts designed for accumulating savings with interest.

- CD (Certificate of Deposit): Fixed-term deposits with guaranteed interest rates.

- IRA (Individual Retirement Account): Retirement savings accounts with tax advantages.

- Investments: Products like mutual funds, stocks, or bonds for wealth growth.

- Mortgage: Loans for purchasing homes or properties.

- Credit Card: Revolving credit for purchases, often with rewards or cashback programs.

4. Core Capabilities

Core capabilities represent the essential processes and functions that enable the bank to deliver its products and services. These are grouped into several subcategories:

Product Class – Deposits

- Checking Accounts: Managing transactional accounts with features like overdraft protection.

- Credit Accounts: Handling credit-based accounts, such as credit cards or lines of credit.

- Private Banking: Exclusive services for high-net-worth clients, including wealth management.

- Wealth Management: Investment advisory and portfolio management services.

- Savings Accounts: Managing interest-bearing savings accounts.

- Time-Based Deposit Accounts: Handling fixed-term deposits like CDs.

Account Management

- Account Closure: Processes for closing customer accounts.

- Account Origination: Opening new accounts, including verification and setup.

- Customer-Triggered Events: Handling events like address changes or account updates.

- Fulfillment: Delivering account-related materials, such as debit cards or statements.

- Deposit Funds: Processing deposits via various channels.

- Online Bill Pay Services: Facilitating bill payments through online platforms.

- Transfer Funds: Enabling fund transfers between accounts or to external entities.

- Account Fulfillment: Ensuring account setup and maintenance meet customer needs.

- Configuration Services: Customizing account features based on customer preferences.

- Customer-Triggered Events: Managing events initiated by customers, such as stop payments.

- Debit & ATM Card Services: Issuing and managing debit and ATM cards.

- Small Business: Tailoring account services for small business clients.

- Update Information: Updating customer or account details.

- Withdraw Funds: Processing withdrawals through various channels.

- Transaction Banking: Managing high-volume or specialized transactions.

Customer Information Management

- Contacts: Managing customer contact details, such as phone numbers and emails.

- Preferences: Tracking customer preferences for communication and services.

- Security: Ensuring customer data protection and secure access.

- Entity: Managing customer profiles, including personal and business entities.

- Relationships: Tracking relationships between customers, such as joint accounts.

- Risk Profile: Assessing customer risk for fraud or credit purposes.

- Account Analysis: Analyzing account activity for insights and reporting.

- Commercial Services: Providing business-specific customer information services.

- Payment Services: Managing payment-related customer data.

Billable Services

- Cash Management: Services for managing cash flow, especially for businesses.

- Core Management Services: Central services for account and transaction processing.

- Safe Deposit Box: Offering secure storage for valuables.

- Cashier’s Check: Issuing certified checks for guaranteed payments.

- Money Orders: Providing money orders for secure payments.

- Overdraft Services: Managing overdraft protection and fees.

- Trust Management: Administering trust accounts and fiduciary services.

Account Processing

- Adjustments: Correcting errors or discrepancies in accounts.

- Balance Processing: Calculating and updating account balances.

- Exceptions: Handling unusual transactions or errors.

- General Ledger: Maintaining the bank’s financial records.

- Reconciliations: Ensuring account balances match transaction records.

- Sales: Supporting sales of banking products and services.

- Partnerships: Managing relationships with external partners.

- Sales and Incentives: Tracking sales performance and customer incentives.

- Customer Relationship Management: Building and maintaining customer relationships.

- Prospect Management: Managing potential customers and leads.

Reporting and Analysis

- Accounting Reports: Generating financial reports for internal and regulatory purposes.

- Customer Reporting: Providing customers with account activity reports.

- Operational Reporting: Monitoring operational performance.

- Regulatory Reporting: Complying with regulatory reporting requirements.

- Transaction Banking Reporting: Reporting on transaction banking activities.

- System Utilization: Analyzing system performance and usage.

Transactions

- Billing: Issuing invoices for services or fees.

- End of Day & Batch Posting & Opening: Processing transactions at the end of the day.

- Process Electronic Transactions: Handling electronic payments and transfers.

- Real-Time Payments: Processing instant payment transactions.

- Statements: Generating and delivering customer statements.

- Check Processing: Processing checks for deposits and payments.

- Lockbox Management: Managing lockbox services for payment collection.

- Process Loan Transactions: Handling loan-related transactions.

- Transaction Banking: Managing high-volume transaction processing.

- Day 1 & Day 2 Processing: Handling daily transaction cycles.

- Payment Processing: Processing various payment types.

- Preparation Considerations: Preparing for transaction processing.

- Process Deposits: Handling deposit transactions.

- Process Originations: Managing the origination of loans or accounts.

- Transfer Process: Facilitating fund transfers.

Data Analytics and Processing

- Analytics: Analyzing data for insights into customer behavior and trends.

- Customer Information: Managing and analyzing customer data.

- Data Warehouse: Storing and organizing large volumes of data.

- Ops Data Store: Maintaining operational data for quick access.

Statements

- Online Statement Generation: Providing digital account statements.

- Statement Definition: Defining statement formats and content.

- Statement Archive: Storing historical statements.

- Statement Generation: Creating statements for customers.

- History: Maintaining transaction and account history.

- Statement Capabilities: Supporting advanced statement features.

Document Management

- Account Fulfillment: Delivering account-related documents.

- Disclosure & Agreement Acceptance Processing: Managing legal documents and agreements.

- Templates: Creating standardized document templates.

- Correspondence: Handling customer communications.

Investment Services

- Investment Management: Managing customer investment portfolios.

- Finance & Treasury: Overseeing the bank’s financial operations.

Communications Management

- Alerts & Notifications: Sending alerts for account activities or promotions.

- Human Interactions: Managing direct customer communications.

Marketing

- Campaign Management: Planning and executing marketing campaigns.

- Collateral Management: Creating marketing materials.

- Surveys and Research: Conducting customer research and surveys.

Product Management

- Information: Managing product-related information.

- Methods: Defining product delivery methods.

- Parameterization: Setting product parameters, such as interest rates.

- Price, Fees, & Rates: Determining pricing and fee structures.

- Product Management: Overseeing product development and lifecycle.

- Capabilities: Defining product features and capabilities.

- Role Definition: Assigning roles for product management.

- Relationships: Managing product-related partnerships.

- Rules Engine Definition: Setting rules for product operations.

5. Support Capabilities

Support capabilities ensure the bank operates securely, complies with regulations, and maintains operational efficiency. These are grouped into several subcategories:

Identity & Security Management

- Authentication: Verifying customer identities for secure access.

- Customer ID Validation: Validating customer identities during onboarding.

- Single Sign-On: Enabling seamless access across platforms.

- System Security: Protecting systems from cyber threats.

- Provisions: Managing security provisions and policies.

Quality Assurance Management

- Parameter Gathering: Collecting data for quality assurance.

- QA Inspection: Conducting quality checks on processes.

- QA Notification: Notifying stakeholders of quality issues.

- QA Revision: Revising processes to improve quality.

Compliance Management

- Consumer Privacy: Protecting customer data privacy.

- FDIC Regulations: Complying with federal banking regulations.

- Local State Regulations: Adhering to state-specific banking laws.

- U.S. Regulations: Following national regulatory requirements.

Risk Management

- Account Restrictions: Applying restrictions to mitigate risks.

- Credit Bureau: Checking credit reports for risk assessment.

- Risk Thresholds: Setting limits for acceptable risk levels.

- Assessment & Model: Developing models for risk evaluation.

Fraud Management

- Know Your Customer (KYC): Verifying customer identities to prevent fraud.

- Transaction Behavior: Monitoring transactions for suspicious activity.

Monetary Assessment

- Available Funds: Assessing available funds for transactions.

- Claims & Disputes: Handling customer disputes and claims.

- Expense Assessment: Evaluating operational expenses.

- Revenue Assessment: Analyzing revenue streams.

Infrastructure Management

- Database Management: Managing data storage and retrieval.

- Hardware Management: Maintaining physical infrastructure.

- Messaging Management: Handling internal and external messaging systems.

- Platform Management: Overseeing banking platforms and applications.

Conclusion

The Retail Banking Business Architecture diagram is a structured representation of the interconnected components that drive a retail bank’s operations. By categorizing functions into customer segments, channels, products, core capabilities, and support capabilities, it provides a clear roadmap for delivering customer-centric services while maintaining operational excellence. Each component plays a critical role in ensuring that the bank meets customer needs, complies with regulations, and operates efficiently in a competitive financial landscape. This architecture is invaluable for stakeholders seeking to design, optimize, or transform retail banking operations.